Perfect Competition in Stock Market and Concentration of Brokerage House Industry: Case of Turkey

Introduction

Competition and concentration are the significant features of any market, and the nature of them are mostly affected by the globalization, technological developments, economic crisis, entries and exits, and regulations. However, the effects of such things change from market to market. These effects lead to the higher or lower competition in a market. The more competitive market means lower prices, more choices for consumers, better products with improved quality, and more innovative firms (ABA 2014).

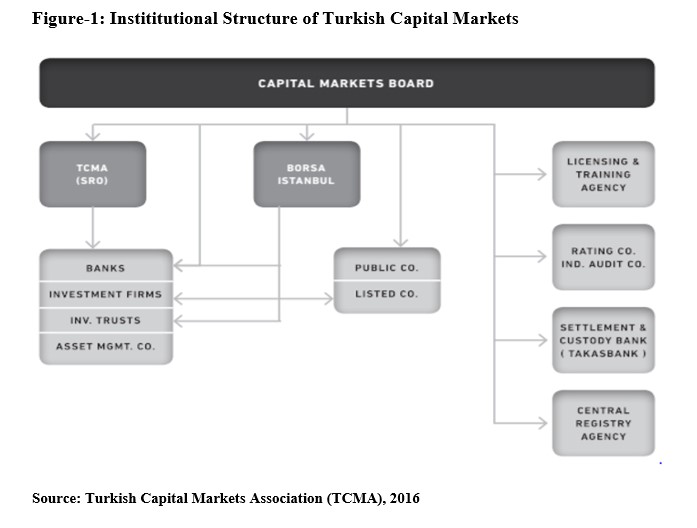

In this paper, we examine the stock market as an example of perfect competition market and the degree of competition and concentration in the Turkish Brokerage House Industry, which is an important part of the Turkish Capital Markets. We know that global and domestic economic crises have highly affected the financial industry in Turkey (Kasman and Torun 2015). Hence we have seen many regulations. The Turkish financial industry has been restructured especially after the financial crisis of 2001. With that restructuring process, Capital Markets Board (CMB) has become the most influential actor and main authority in the Turkish Capital Markets (TCMA 2007). Thus brokerage houses in Turkey are the one group of the institutions that operate under CMB. Figure-1 shows the institutional structure of Turkish Capital Markets.

By operating under CMB regulations, brokerage houses, in other words, investment firms as seen in the Figure-1, service many investment products such as stocks, futures, options, bonds, and foreign exchanges in Borsa İstanbul. However, trading of stocks is the main business of the most of the Turkish Brokerage Houses. Therefore, we will assess the competition and concentration in the stock market .

The rest of the paper is organized as follows: Section 2 provides an analysis of stock market participants based on the perfect competitive market basics. Section 3 provides a measure of concentration degree of Turkish Brokerage House Industry. Section 4 is devoted the conclusions.

Turkish Stock Market As A Perfect Competitive Market Example

Stock markets are considered as an example of perfect competition market. We know that in the perfect competition market, there are many buyers and sellers, homogenous products, free exits and entries, perfect information, and no transaction costs (Baye 2013).

The structure of stock market consists of corporations, brokerage houses, buyers and sellers. Let’s firstly define them, and then measure the competition and concentration in the brokerage house industry based on the stock trading services.

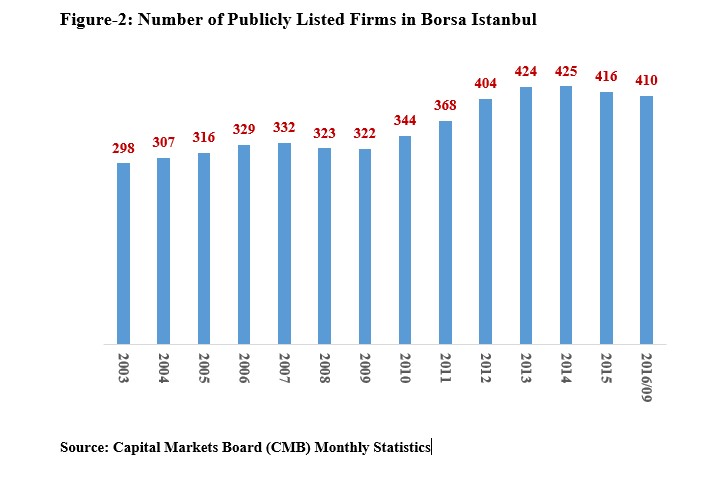

Corporations are the firms that are publicly listed in Borsa Istanbul. Their shares are bought and sold by investors. According to the data taken from TCMA report, as of September 2016, there are 410 firms whose shares are publicly traded. As Figure-2 shows, until 2014, number of publicly listed companies had increased, but by 2015, they have started to decrease. However, existing firms have millions of shares traded in stock market and all shares have identical features. That identical stocks as products lead us to consider stock market as perfectly competitive.

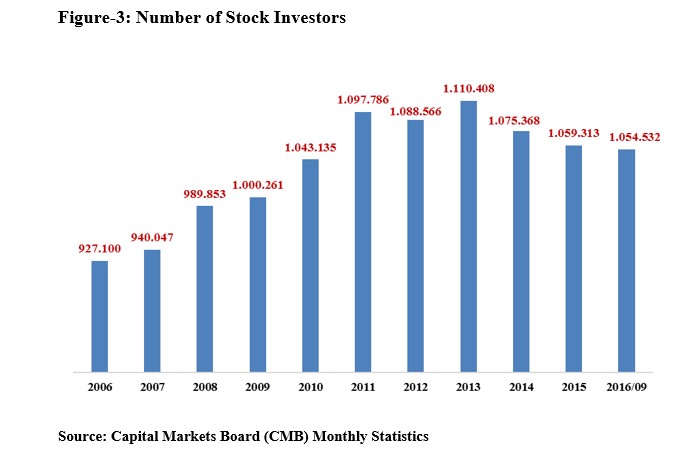

Investors are the buyers and sellers of the stocks. Investor who buys the stock becomes to one of the shareholders of the firm in order to get benefits from the firm’s possible profitability in the future. In contrast, investor who sells the stock aims to get cash. As Figure-3 shows, there are hundred of thousands of stock investors, and they are no effect on stock prices, that is, they are price takers. Thus it lead us to think stock market as perfectly competitive.

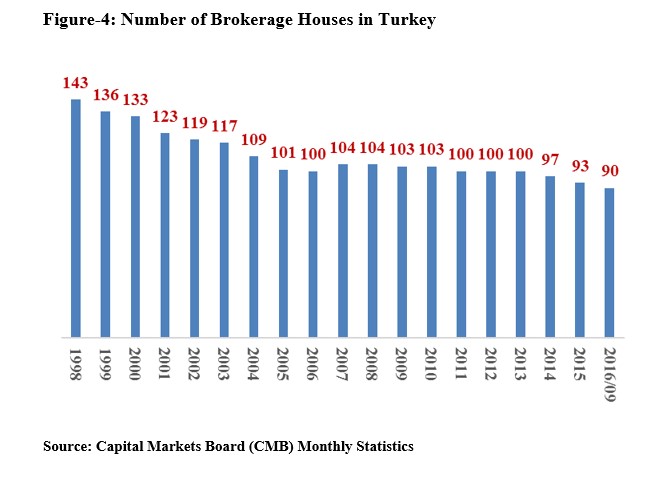

Brokerage houses are the market makers of the stock market, and provide trading platforms for investors in order to buy and sell the millions of shares. By the economic crises and CMB regulations in the last decade, we have seen some consolidation as a form of industry exits in the Turkish Brokerage House industry. As Figure-4 shows, the number of brokerage houses in Turkey is 90 as of September 2016, but only 64 of them operates in stock trading as in 2016.

Although there is a decreasing trend in the number of firms in the brokerage house industry, it can still be accepted as perfect competitive market since there are enough number of firms and they give the same stock trading services. However, some of them try to differentiate themselves with offering new trading platforms as electronic trading of stocks or lower commission rates to the customers.

Measuring Market Concentration of Turkish Brokerage House Industry

In an industry, the degree of competition and concentration is measured by specific techniques such as CR3, CR4, CR5, HHI and H-Statistics (OECD 2010). In these techniques, market shares of the firms are used as an attractive variable (Koetter 2013). We know that higher concentration leads to lower competition in a given industry, that is, there is a negatively relationship between the competition and the concentration degree.

In order to measure the competition and concentration degree in the brokerage house industry in Turkey based on the stock market, we will use two techniques. One of them is the four-firm concentration ratio (C4), which is the sum of the market shares of the four largest firms in the industry, and the other one is Herfindahl-Hirschman Index (HHI), which is calculated by adding up the squared market shares of all firms in the industry, multiplied by 10,000 to disregard the need for decimals (Baye 2013).

C4 = W1 + W2 + W3 + W4 (where Wi is market share of ith firm)

HHI = 10,000 ∑wi2

In the previous section, we have considered the brokerage house industry in Turkey as perfect competitive market based on stock market. Now, let’s measure the competition degree by our two concentration techniques. According to C4 ratio, the total market share of the largest four brokerage houses in the total stock trading volumes is 29.88% in 2016, which means that there is less concentration in the stock market and high competition. In addition, HHI value is 422.0 in 2016, which also leads to high competition as a result of low concentration. Both concentration measures imply that Turkish Brokerage House Industry has almost perfect competition. No brokerage house in Turkey has a stock market share above 10%. However , although Table-1 shows some increasing concentration in the industry based on C4 and HHI values, it is mostly caused some regulations of CMB and industry exits.

Conclusion

This study has been an analysis of competition in the Turkish stock market and degree of concentration in the Turkish brokerage house industry. Our analysis proves that stock market in Turkey indicates the characteristics of perfectly competitive market. In addition, we have measured the competition level in the brokerage house industry with a C4 value of 29.88% and a HHI value of 422, which indicates lower concentration and higher competition in the brokerage house industry in Turkey.

References

Books

Baye, Michael R. & Prince Jeffrey T., 2014. Managerial economics and business strategy. 8th edition. New York: McGraw-Hill

Other Publications

Australian Bankers’ Association (ABA) and Deloitte. 2014. Competition in Retail Banking. March. Australia.

Capital Markets Board (CMB). 2016. Turkish Capital Markets Monthly Bulletin. September. Istanbul.

Kasman, Adnan & Torun, Erdost. 2007. Long Memory in the Turkish Stock Market Return and Volatility. Central Bank Review 2. Pp. 13-27.

Koetter, Michael. 2013. Market structure and competition in German banking-Modules I and IV. October. Frankurt.

OECD. 2010. Competition, Concentration and Stability in the Banking Sector. September. Paris.

Turkish Capital Markets Association (TCMA). 2007. Turkish Capital Markets & The Brokerage Industry 2007. July. Istanbul.

Turkish Capital Markets Association (TCMA). 2016. Handbook of The Turkish Capital Markets 2016. February. Istanbul.

Turkish Capital Markets Association (TCMA). 2016. Handbook of The Turkish Capital Markets 2016. February. Istanbul.