Things Everyone Should Know About Roth IRA

Roth IRAs are highly preferred by people for their retirement savings with offering tax-free investments. According to many people, it is the one of the best ways to save for retirement. The biggest advantage of Roth IRA is that you are not taxed when you withdraw. You are taxed when you make contribution. That is, its motto can be as “Pay taxes now, enjoy tax-free withdrawals later”.

In this article, I will explain the main points related to Roth IRA at a glance. After reading this article, I hope you will get all necessary information about Roth IRA. Let’s start then…

What is a Roth IRA retirement?

Roth IRA is named for Senator William Roth and established by the Taxpayer Relief Act in 1997.

Roth IRA, Individual Retirement Account, is a type of qualified retirement plan in which your money grows tax-free and your withdrawals will be tax-free in retirement. That is, since you fund your Roth IRA with after tax-dollars, you pay no taxes when you withdraw at retirement. This makes Roth IRA a popular retirement plan.

How you can establish a Roth IRA?

Please do not forget that when you decide to set up a Roth IRA, you have to maintain it outside of your retirement savings plan which sponsored by your employer.

You can establish a Roth IRA in the institutions approved by IRS including brokerage firms, banks, federally insured credit unions, and savings and loan corporations. You can establish your Roth IRA in these institutions whenever you want, but you must make your contributions until tax-filing deadline which is April 15 of the following year in general.

You must be given the IRA disclosure statement and the IRA adoption agreement and plan document. These documents indicate the rules and regulations about your IRA, and agreement between the trustee and you.

When you open Roth account, you provide the following documents to your institution such as your bank number and checking and saving account, a form for photo identification such as driver’s license, your social security number, information about your employer, information about your Roth IRA beneficiary.

On the other hand, you should consider the following points when establishing your Roth IRA. If necessary, you should ask a financial advisor for help.

- Different institutions offer different investment options for your Roth IRA with different fees. While some of them have large options, others have limited options. Their fees affect potential returns for you.

- If you open your IRA account in an institution in which you already have accounts, ask for any benefits or discounts for existing clients’ Roth IRA accounts.

- You must be sure about that the structure of Roth IRA that is offered to you is in line with your risk profile and investment preferences. Since there are many asset classes (stocks, bonds, mutual funds, ETFs, etc.) with different risk levels, you must know your risk tolerance.

After opening your Roth account, you can make your initial contributions…

Which institutions can be the best for your Roth IRA?

- Betterment

- Vanguard

- Fidelity

- Charles Schwab

- Wealthfront

- M1 Finance

- Ally Invest

- Personal Capital

- Stash

- Acorns

- E*TRADE

What are the benefits or advantages of Roth IRA?

- Your money grows tax-free since you fund it with after tax-dollars.

- You withdraw your money at retirement without paying any taxes.

- You can continue to contribute to your Roth IRA after retirement.

- Your beneficiaries who will inherit your Roth can withdraw the funds with no taxes as well

- There is no requirement for distributions, or RMDs for as long as you live. Therefore, investments in your Roth grows completely tax-free and only tap the funds when you need them.

- There is no maximum age for contributions.

- There are no employer-sponsored plan restrictions.

- You can use your Roth IRA funds to pay for qualified college expenses without an early distribution penalty.

What are the withdrawal requirements for Roth IRA?

You must be at least 59½ years old and you must contribute to Roth IRA at least 5 years in order to make “qualified distributions” in retirement. On the other hand, at any time, you may withdraw contributions from your Roth IRA both tax- and penalty-free, but you will be penalized for earnings from investments when you withdraw them before age 59 ½, unless it’s for a qualifying reason.

For instance, your Roth IRA has $50,000. $40,000 of them are contributions and $10,000 of them are earnings from investments. If you withdraw $45,000, the IRS will consider $40,000 of that to be contributions and $5,000 to be earnings. Therefore, there will be penalty for only $5,000.

Moreover, depending on some conditions, there are probably some exceptions when the funds are used for paying medical expenses, qualified-higher education expenses, unreimbursed medical expenses, etc.

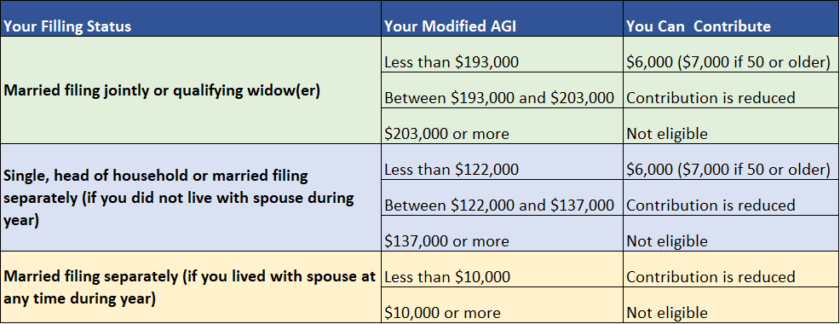

What are the contributions limits for Roth IRA? Are you eligible?

For your Roth IRA, you can make an annual contribution of up to $6,000 in 2019. If you are age 50 and older, it will be $7,000 with the effect of catch-up contribution.

There are some eligibility requirements for Roth IRA which are summarized in the following picture.